Gold was one of the few asset classes to post positive returns in 2008, as investors sought hard assets in a flight to safety. The price of the yellow metal rose 3% in 2008, while the S&P lost 37% of its value, the MSCI All World Ex-US was down 43%, and the broad GSCI commodity index fell 47%. Gold even outperformed most hedge funds, who quite embarrassingly failed to live up to their name as the Barclay Hedge Fund Index showed the average fund earning their 2/20 by returning -22% to their customers.

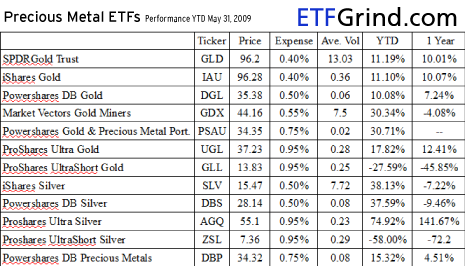

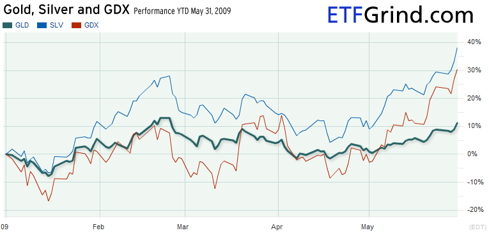

Even as the economic crisis has abated and other assets - most notably emerging market equities - have recovered, interest in gold and other precious metals has remained strong. Safety buying has continued, but gold's 11% and silver's 38% YTD returns are best explained by the rising fears of inflation. As central banks around the world increase the money supply rapidly to fend off deflation, they run the risk of causing inflation in the future.

Historically gold and silver have been effective inflation hedges because of their dual roles as both commodities and currencies. The prices of all commodities rise during periods of high inflation simply because the currencies they are priced in are worth less in real terms. But gold and silver also function as currencies (XAU and XAG) which benefit directly from investors' desire to diversify away from a declining fiat currency like the USD.

Although there are other good ways to protect against inflation, gold and silver have the most potential upside largely because of their unique roles as the only non-paper currencies at a time when nearly every paper currency is at risk of losing real value.

Investments in gold and silver are risky themselves, however. Although both have intrinsic value, they trade at their values as currencies, which is highly dependent on investor sentiment. No one has to own gold in the same way that people must own Euros or Yen. After gaining strongly in the 1970's the price of gold collapsed in the 1980's and remained moribund until early this decade. Prices tend to soar during crisis, and collapse once the crisis is over. Investors must know when to sell, but a lot of money can be made between then and now.It must be said first that some have seen additional risk in precious metal ETFs because they don't offer investors the real, "hard" asset. Like all ETFs, precious metal funds issue shares whose value is determined by their holdings, and the investor legally owns those shares - not the holdings themselves.

For many goldbugs, this intermediary is a source of unacceptable risk as it exposes them to potential accounting fraud by the issuer, a shutdown of the stock exchange, government confiscation of their shares, or some other black swan event.

These are risks any investor takes, however, when he purchases any investment product that's not stored in his basement. And their disclosure requirements make Exchange Traded Funds the most open, transparent and liquid paper asset available. Precious metal ETFs are widely owned by institutional investors and large individual investors, including John Paulson - the one hedge fund manager who saw this crisis coming. And their management expenses are negligible compared to the costs of storing and protecting your own stash of gold.

So as always ETFs are the cheapest, safest way to own precious metals. This guide will brief you on all 12 gold and silver ETFs traded in the United States, 10 which follow their metal's price and two which follow the equities of gold miners. Normally platinum and palladium are also considered precious metals, but no US listed ETF currently tracks their price, although one that tracks platnium has been registered.

Gold

SPDR Gold Shares Trust (GLD) +11.18% ytd

The GLD's 34 billion dollar market cap makes this ETF one of the largest on Earth. The fund invests in gold bullion bars which are stored with HSBC in London. Its shares are neatly divided into increments meant to track 1/10th the spot price of gold, minus fees. The GLD's mega trading volume gives investors liquidity, and its .4% expense ratio is a great deal cheaper than holding your gold in a vault (which is currently running at about 2%).

COMEX Gold Trust (IAU) +11.09% ytd

The IAU is the primary alternative to the GLD. It carries an identical expense ratio and boasts very good liquidity. The only major difference seems to be with the custodial bank. The GLD's gold is held by HSBC in London. The IAU's gold is held in vaults around the world by the Bank of Nova Scotia. Both accounts are governed by American law, but HSBC's parent is British and BNS ' is Canadian, which may or more likely may not have regulatory implications. In the event of a force majeure invocation (London is destroyed?), the IAU's more diverse holdings might be more secure.

PowerShares DB Gold Fund (DGL) +10.08% ytd

The DGL is a thinly traded fund that has an expense ratio of .5% compared to the .4% of the two funds above. Unlike the GLD and IAU it doesn't actually invest in any bullion, but tracks the price through derivatives contracts. Its high fees and transaction costs mean it will always underperform its competitors. Why it still trades is anyone's guess, but it appears to have something to do with index provider Deutsche Bank wanting to have a full range of products in the US.

Gold Equities

Van Eck Market Vectors Gold Miners (GDX) +30.33% ytd

Often times the best way to play a commodity is to invest in the companies that produce it. The GDX tracks an index of 27 gold mining companies from around the world. It has outperformed GLD handsomely this year. Aside from the potential outperformance, the GDX has another advantage over the bullion funds. Due to a quirk in US tax law, gains from ETFs that invest in gold bullion are taxed as collectibles [sic] while the GDX is taxed as normal capital gains. At the moment that means the difference between 15e% for the GDX and up to 28% for the GLD, although the capital gains rate will be reset to 20% in 2010, closing that gap a bit.

PowerShares Gold and Precous Metals Portfolio (PSAU) +30.71 ytd

Although at first glance the PSAU may seem a tempting alternative to the GDX, it's pretty much the same product. Both indexes are global, and most gold miners also have silver operations so the GDX will benefit from silver's rise as well. With nearly identical performances, the PSAU's expense ratio and terrible volume make the GDX the better choice.

Leveraged

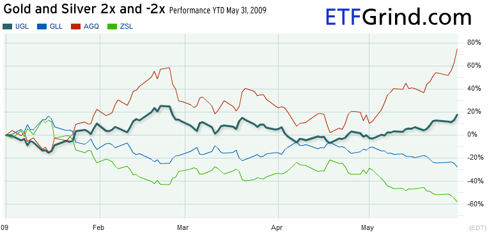

ProShares Ultra Gold (UGL) +17.82% ytd

The UGL is a typical 2x leveraged ETF that aims to return 200% of the daily change in the price of gold. Like all leveraged products there is significant risk in holding the UGL over the long term because daily changes can add up to odd annual returns, and its .95% expense ratio is a deal breaker.

ProShares UltraShort Gold (GLL) -27.58% ytd

The GLL is currently the only short gold fund available in the US. It shares the same leverage risks as its UGL counterpart, but could be worth a look in a few years' time if gold starts to fall.

Silver

iShares Silver Trust (SLV) +38.13 ytd

Silver has been the best performing commodity this year, up almost 40% ytd. iShares' silver offering is a large, liquid fund that invests in silver bullion stored in London with JP Morgan Chase as its custodian bank. Its share price is designed to replicate the spot price of one ounce of silver, minus fees.

Powershares DB Silver Fund (DBS) +37.59 ytd

DBS is microscopic compared to the SLV. It is a derivatives only fund that carries an identical .5% expense ratio. Stick with the SLV unless you can think of a reason why futures contracts should outperform their underlying commodities.

Leveraged

ProShares Ultra Silver (AGQ) +74.92% ytd

The AGQ seeks to track twice the daily change in the price of silver. The same risks apply for holding over the long term as any leveraged ETF, although it may be tempting to hold for a few weeks to follow a strong silver rally.

ProShares UltraShort Silver (ZSL) -58.00% ytd

The ZSL may be an interesting play when silver starts to head down. It already has high volume, as traders try to take advantage of silver's day-to-day volatility.

Precious Metals

Powershares DB Precious Metal Fund (DBP) +15.32% ytd

The DBP invests in bullion at a 80% gold 20% silver ratio. Its holdings are value weighted so its silver percentage may increase over time if that metal continues to outperform. It isn't a bad idea to have diversification in one fund, but DBP's high fees (.75%) make it a better proposition to simply buy the GLD and SLV separately.

(from SeekingAlpha, June 1, 2009)

No comments:

Post a Comment