Ivanhoe Mines is at a two-year high, and the option action is looking for it to continue running higher.

The Canadian gold and copper mining company is up at $14.94, falling slightly from the open and trading just below the high of $15.19 set yesterday, the highest level since November 2007. IVN is up almost 50 percent since finding support at the beginning of November and more than 500 percent for 2009.

The average daily options volume is has been fewer than 3,000 contracts total in IVN, and despite the holiday slowness we see one block of 4,100 June 15 calls traded today. The calls were bought for $2.25 against open interest of 3,608 contracts.

This call buying is a bet that IVN will be above the all-time high for the stock set in July 2007. This is one way that traders have been trying to leverage the higher price of gold and other precious metals.

(Chart courtesy of tradeMONSTER)

We looked at this question from an open interest perspective in mid-December ("When Will The Gold Froth Dissipate?").

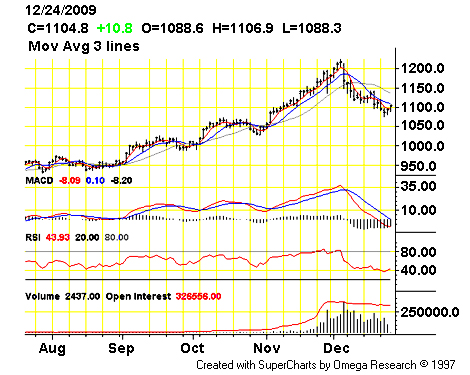

COMEX/NYMEX Gold (Feb. '10)

February gold is dawdling around the $1,100 mark now, seemingly ready to take a breather from its nearly monthlong swoon.

Some bulls, however, are waiting for a full 50 percent retracement of the contract's July-December rally as a buy-in point. That's $1,068 for the February contract. A number of traders, too, are selling puts struck at $1,070 as a way to capture a sale price on gold futures.

Here's the deal: Puts, as you may know, bestow the owner with the right, but not the obligation, to sell gold futures at the strike price. For this right, the put buyer pays cash to the option's seller. The seller, in consideration of the cash premium received, undertakes the obligation to buy futures at the strike price if, and when, the put buyer exercises his or her option.

Now, it's likely the put owner will only exercise the option if the underlying futures' price dips below the strike price. The economic advantage for "putting" gold futures to the option seller is equal to the difference between the strike price and the current market price of futures.

Think about those $1,070-struck puts. Put owners would only want to exercise (sell futures) if February gold's below $1,070. The farther below the strike February gold declines, the greater the economic gain upon exercise.

For the option grantor, it's pain, not gain, that increases with a decline in gold's price since he or she would be obliged to buy futures at the strike price.

But if you wanted to be a gold buyer on a dip to the 50 percent retracement level (near $1,070), that's exactly the kind of risk you'd be taking. The only difference between placing a buy limit order under the market at $1,068 and selling puts struck at $1,070 is the premium you receive for selling the option.

As gold closed out pre-holiday trading, the $1,070-struck put's premium was $14.30 an ounce. That means your effective gold futures purchase price would be $1,055.70 ($1,070 - $14.30) upon exercise.

Is that a good sale price for gold? It certainly is compared with $1,100.

What if February gold doesn't dip below $1,070 after selling the put? What then? Well, the same that would happen with a resting buy limit order at $1,070. Nothing.

It's not likely the put holder would want to exercise the option if February gold's trading above the strike price. There's only economic disadvantage in that since he or she would end up short futures.

The good news for the option grantor is that he/she gets to keep the premium. If February gold is at $1,100, for example, when the put expires, you can use the retained premium to lower the purchase price - or margin requirement - of the then-active gold futures by $1,430.

You can use this same approach with ETFs on gold bullion. The 50 percent retracement level for the SPDR Gold Trust Shares (NYSE Arca: GLD) is just above $104. With shares of the grantor trust trading around the $108 level now, the premium for a $104 put is about $2.06 a share.

The Market Vectors Gold Miners ETF (NYSE Arca: GDX), now trading with a $46 handle, has already rebounded from a test of its 50-retracement level around $44.80.

(from SeekingAlpha, December 29, 2009)

No comments:

Post a Comment